Mastering Revenue Cycle Management

An End-to-End Guide for Healthcare Providers

The financial heartbeat of any healthcare organization relies on an efficient and robust Revenue Cycle Management (RCM) system. In today’s complex healthcare landscape, where evolving regulations, intricate payer rules, and increasing patient financial responsibility are the norm, merely providing excellent medical care isn't enough to ensure a practice's long-term sustainability. Healthcare providers must master the art and science of RCM to thrive.

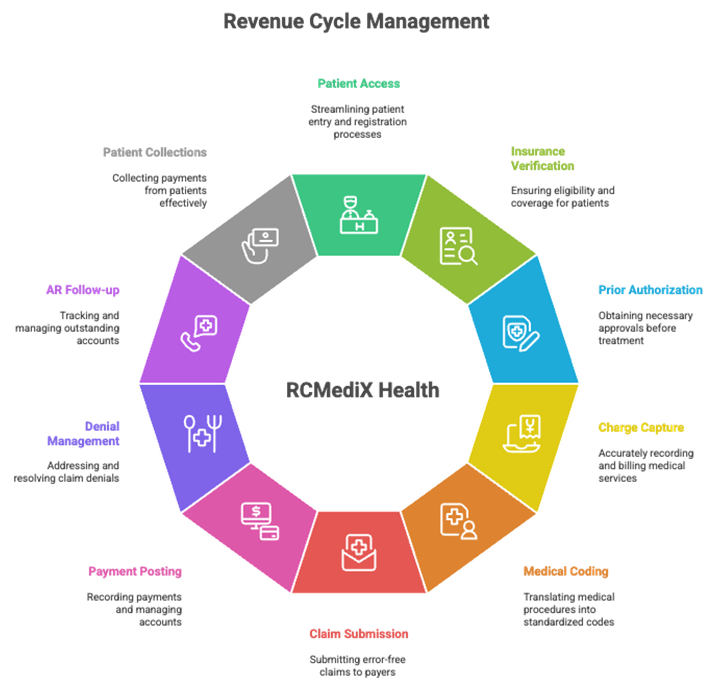

At RCMediX Health, we understand that Revenue Cycle Management is far more than just medical billing; it's a comprehensive process encompassing all administrative and clinical functions that contribute to the capture, management, and collection of patient service revenue. From the moment a patient schedules an appointment to the final resolution of a payment, every step in the RCM journey directly impacts an organization’s financial health and operational efficiency. An optimized RCM system is the bedrock for consistent cash flow, reduced claim denials, enhanced profitability, and ultimately, the ability to reinvest in patient care.

This end-to-end guide will demystify the entire RCM process, breaking down each critical stage and highlighting how a strategic approach, exemplified by RCMediX Health‘s methodologies, can transform your financial outcomes. We’ll explore the front-end, mid-cycle, and back-end processes, common challenges, best practices for optimization, and the invaluable role of robust analytics and compliance.

I. The Front-End: Laying the Foundation for a Healthy Revenue Cycle

The journey towards successful revenue capture begins long before a patient steps into your clinic or hospital room. The front-end of the RCM process focuses on pre-service activities that are paramount to preventing errors, reducing denials, and ensuring a smooth financial experience for both the provider and the patient. This foundational stage sets the trajectory for the entire revenue cycle.

1. Patient Access & Pre-Registration: The First Impression

Description: Patient access and pre-registration involve systematically collecting accurate demographic, insurance, and preliminary medical history information from a patient before they receive services. This crucial step is often the patient’s first significant interaction with the healthcare system regarding their administrative and financial data, making it a pivotal moment for setting expectations and ensuring data integrity.

Process:

- Initial Data Collection: Whether through online patient portals, dedicated phone lines, or digital intake forms, the process begins with gathering essential details like full name, date of birth, contact information, emergency contacts, and the primary reason for their visit.

- Appointment Scheduling: As appointments are scheduled, the pre-registration process often kicks in, prompting patients to provide their information in advance. Automated appointment reminders can also serve as a prompt for patients to complete any outstanding pre-registration tasks.

- Patient Portal Utilization: Modern RCMediX Health solutions leverage secure patient portals where individuals can conveniently input their information from home, upload identification and insurance cards, and even review their medical history. This not only streamlines the check-in process but also empowers patients to provide accurate data at their own pace.

Importance: Errors or omissions at this initial stage can cascade through the entire RCM process, leading to delayed payments, claim denials, and frustrating patient experiences. Accurate pre-registration prevents downstream billing headaches by ensuring that the foundational patient data is correct from the outset. It also significantly improves the patient experience by reducing wait times at check-in and allowing for transparent discussions about financial responsibility. For RCMediX Health clients, optimizing this stage means faster processing times and a reduction in administrative burden for front-office staff.

2. Insurance Eligibility Verification: Confirming Coverage Confidence

Description: Following pre-registration, the next critical step is insurance eligibility verification. This involves confirming the patient’s insurance coverage, ensuring their policy is active, and understanding the specific benefits available for the planned medical services. It’s about answering the fundamental question: “Is this patient covered for this service?”

Process:

- Real-Time Verification Tools: The most efficient method for eligibility verification is through real-time electronic transactions (EDI 270/271). These automated systems allow healthcare providers, or their RCM partners like RCMediX Health, to instantly query payer databases for eligibility status.

- Detailed Benefit Checks: Beyond just active coverage, a thorough verification process includes checking critical details such as:

- Co-pays and co-insurance amounts

- Annual deductibles met and remaining

- Out-of-pocket maximums

- Specific coverage for the planned procedures or services (e.g., lab tests, imaging, specialist visits)

- In-network vs. out-of-network benefits

- Manual Verification (as needed): For complex cases, new insurance plans, or issues with electronic systems, manual verification via phone calls to payer hotlines may still be necessary.

- Patient Communication: Once eligibility and benefits are confirmed, transparently communicating the patient's estimated financial responsibility upfront (co-pays, deductibles, non-covered services) is vital for patient satisfaction and successful point-of-service collections.

Importance: Insurance eligibility verification is a cornerstone of claim denials prevention. A significant percentage of claim denials stem from issues with eligibility or benefits. Performing this step accurately and proactively prevents costly rework, improves cash flow, and eliminates “surprise billing” for patients, fostering trust. By leveraging advanced tools, RCMediX Health ensures that practices are well-informed of patient coverage, drastically reducing the risk of non-reimbursable services.

3. Prior Authorization: The Green Light for Treatment

Description: Prior authorization (also known as pre-authorization or pre-certification) is the process of obtaining explicit approval from the insurance payer for specific medical procedures, medications, or services before they are actually rendered. It’s the payer’s way of confirming medical necessity and approving coverage for high-cost or specialized treatments.

Process:

- Identifying Requirements: Healthcare providers must be keenly aware of which services require prior authorization for each specific payer and plan. This can vary widely and is often a complex, constantly updated landscape.

- Clinical Documentation Submission: The core of prior authorization involves submitting detailed clinical documentation to the payer. This includes patient history, diagnosis codes (ICD-10), procedure codes (CPT/HCPCS), results of previous tests, and a compelling medical necessity justification from the treating physician.

- Payer Review: The insurance company's medical review team assesses the submitted documentation against their clinical guidelines and coverage policies.

- Tracking and Follow-up: Due to the often lengthy and intricate nature of this process, meticulous tracking of authorization requests and consistent follow-up with payers are crucial. Missing deadlines or incomplete documentation can lead to automatic denials.

Importance: Prior authorization is another major battleground in the fight against claim denials. Services provided without the required prior authorization are almost always denied, leading to significant lost revenue for healthcare providers. Proactive and efficient prior authorization management ensures that services deemed medically necessary are covered, improving reimbursement rates and reducing the administrative burden of appeals later. RCMediX Health emphasizes streamlined prior authorization workflows, utilizing dedicated specialists and technology to navigate payer-specific requirements and secure approvals efficiently, minimizing delays in patient care and maximizing the chances of full reimbursement.

II. The Mid-Cycle: Documenting Care and Translating into Charges

With the front-end processes efficiently managed, the RCM journey moves into the mid-cycle – the critical phase where clinical services are provided, thoroughly documented, and then accurately translated into billable charges. Errors in this stage directly impact the integrity of the claim and the speed of reimbursement.

4. Patient Registration & Check-in: The Final Verification

Description: While pre-registration initiates the data collection, patient registration and check-in are the final verification steps that occur upon the patient’s arrival for their scheduled appointment. This stage ensures all information is current and accurate immediately before service delivery.

Process:

- Verification of Pre-Collected Data: Front-desk staff confirm the patient's identity, updated contact information, and insurance details gathered during pre-registration. Any changes, such as a new address or insurance card, are updated in the system.

- Identification and Consent: Patients provide photo identification and sign necessary consent forms (e.g., treatment consents, HIPAA privacy acknowledgments).

- Initial Co-pay/Deposit Collection: This is a crucial point for point-of-service collections. Based on the prior eligibility verification, the patient's co-pay, deductible portion, or estimated self-pay amount is collected. Tools provided by RCMediX Health can facilitate easy and secure payment processing at the front desk, including card readers and digital payment options.

Importance: Accurate and complete patient registration at check-in prevents a host of future issues, from claim rejections due to mismatched patient data to difficulties in collecting patient balances. Proactive co-pay collection significantly boosts cash flow and reduces the administrative burden of chasing small balances later. An efficient check-in process, powered by solutions like those offered by RCMediX Health, also enhances patient satisfaction by minimizing wait times and making the administrative process seamless.

5. Charge Capture: Accounting for Every Service

Description: Charge capture is the meticulous process of recording all services, procedures, medications, and supplies provided to a patient during an encounter. It is the crucial link between the clinical care delivered and the financial record created for billing.

Process:

- Physician Documentation: The foundation of accurate charge capture is thorough and precise clinical documentation by the physician or healthcare professional in the Electronic Health Record (EHR) or Electronic Medical Record (EMR) system. This includes detailed notes, diagnoses, procedures performed, and time spent.

- Super Bills/Charge Sheets: In some settings, providers use paper or electronic superbills or charge sheets to mark off services rendered and corresponding diagnoses. These are then transferred to the billing system.

- EHR/EMR Integration: Ideally, the charge capture process is deeply integrated with the EHR/EMR system. This allows for automated charge entry as services are documented, reducing manual errors and missed charges. For instance, an order for a specific lab test within the EHR could automatically generate a corresponding charge.

- Ancillary Department Charges: Charges from ancillary departments like radiology, laboratory, and pharmacy must also be accurately captured and transmitted to the central billing system.

Importance: Charge capture directly impacts a healthcare organization’s revenue. Revenue leakage due to missed or under-coded charges can significantly erode profitability. Conversely, over-coding or unbundling services can lead to compliance issues, audits, and hefty penalties. RCMediX Health emphasizes robust charge capture workflows, implementing regular audits and staff training to ensure that every billable service is accounted for correctly, eliminating costly omissions and inaccuracies. This focus on precision at the point of service is key to maximizing legitimate revenue.

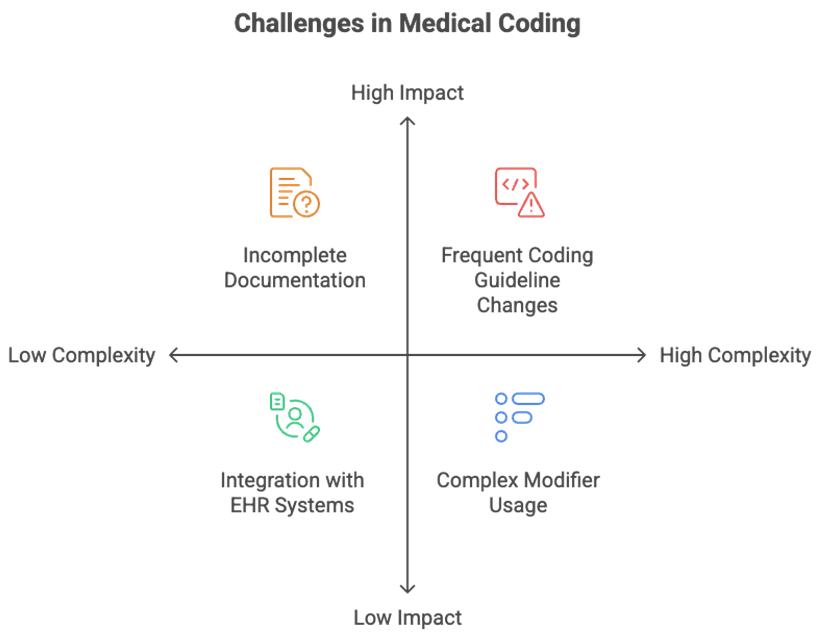

6. Medical Coding: The Language of Reimbursement

Description: Medical coding is the specialized process of translating the narrative of clinical documentation—diagnoses, procedures, medical services, and equipment—into universally recognized alphanumeric codes. These codes form the basis of a healthcare claim and are essential for communication between providers and payers.

Process & Code Sets:

- ICD-10-CM (International Classification of Diseases, 10th Revision, Clinical Modification): These codes describe the patient's diagnosis or health condition. Coders must select the most specific and accurate ICD-10 code based on the physician's documentation. The specificity required (e.g., laterality, episode of care) is critical for reimbursement.

- CPT (Current Procedural Terminology): Developed by the American Medical Association (AMA), CPT codes describe the medical, surgical, and diagnostic procedures performed by healthcare providers. Each code precisely defines a service, ensuring consistency in billing across different providers.

- HCPCS Level II (Healthcare Common Procedure Coding System): These codes primarily cover products, supplies, and services not included in CPT, such as durable medical equipment (DME), ambulance services, and certain medications. They are crucial for billing Medicare and Medicaid services.

Modifiers: These are two-character (numeric or alphanumeric) additions appended to CPT or HCPCS codes. Modifiers provide crucial additional information about a service without changing the original code’s definition. They can indicate:

- That a service was performed by more than one physician.

- A service had professional and technical components.

- A procedure was bilateral.

- Unusual circumstances surrounding a service.

- Example: Modifier -25 indicates a significant, separately identifiable Evaluation and Management (E/M) service was performed by the same physician on the same day as a procedure.

- Role of Certified Medical Coders: Medical coding requires highly specialized training and certification (e.g., CPC, CCS). Certified coders possess deep knowledge of anatomy, physiology, medical terminology, and complex coding guidelines. Their expertise is vital in interpreting clinical documentation, applying correct codes, and ensuring compliance.

Importance: Accurate medical coding is the backbone of a clean claim and directly dictates whether a claim will be paid, denied, or flagged for audit. Coding errors are a primary cause of claim denials, leading to delayed revenue. Missteps like upcoding (billing for a more complex service than performed), under-coding (billing for a less complex service, leading to lost revenue), or unbundling (billing separately for services that should be grouped) can result in severe compliance penalties, fines, and even legal action. RCMediX Health prioritizes precision in medical coding, employing certified experts and leveraging Computer-Assisted Coding (CAC) tools to ensure optimal accuracy, maximize legitimate reimbursement, and uphold strict compliance standards. This diligence at the coding stage is fundamental to a healthy medical billing process.

III. The Back-End: Claim Submission, Payment, and Follow-Up

The back-end of the RCM process is where all the foundational and mid-cycle work culminates in the pursuit of reimbursement. This stage encompasses claim submission, payment processing, diligent follow-up on unpaid claims, and ultimately, patient collections. It’s where strategic efforts translate directly into financial realization.

7. Claim Submission: The Gateway to Reimbursement

Description: Once charges are captured and accurately coded, the next step is to prepare and submit claims to the appropriate insurance payers for reimbursement. The goal is to submit “clean claims” – claims that are free of errors and ready for immediate processing.

Process:

- Claim Scrubbing: Before submission, claims undergo a rigorous process called claim scrubbing. This involves running claims through automated software (often provided by a clearinghouse or integrated into the practice management system) that identifies and flags potential errors, inconsistencies, or missing information. The scrubber checks for correct coding, modifier usage, demographic match, payer-specific rules, and medical necessity. RCMediX Health utilizes advanced scrubbing technology to catch errors that would otherwise lead to denials, dramatically improving the first-pass clean claim rate.

- Electronic Data Interchange (EDI): The vast majority of claims today are submitted electronically via Electronic Data Interchange (EDI). EDI streamlines the exchange of healthcare information (like the ANSI X12 837 transaction for claims submission) between healthcare providers and insurance companies in a standardized, secure format.

- Clearinghouse Role: Most providers submit claims through a clearinghouse. A clearinghouse acts as an intermediary, receiving claims from providers, scrubbing them for errors, translating them into the payer's specific format, and then securely transmitting them to thousands of different insurance companies. They also receive electronic remittance advice (ERAs) back from payers.

- Direct Submission (Less Common): Some very large healthcare systems may have the capacity for direct EDI connections with major payers, bypassing a clearinghouse.

Importance: Timely and accurate claim submission is paramount for rapid reimbursement. A high first-pass clean claim rate means fewer denials, less administrative rework, and a significantly faster cash flow. Errors at this stage can lead to delays, denials, and lost revenue, highlighting the importance of robust claim scrubbing and efficient EDI processes that RCMediX Health provides.

7. Claim Submission: The Gateway to Reimbursement

Description: Once charges are captured and accurately coded, the next step is to prepare and submit claims to the appropriate insurance payers for reimbursement. The goal is to submit “clean claims” – claims that are free of errors and ready for immediate processing.

Process:

- Claim Scrubbing: Before submission, claims undergo a rigorous process called claim scrubbing. This involves running claims through automated software (often provided by a clearinghouse or integrated into the practice management system) that identifies and flags potential errors, inconsistencies, or missing information. The scrubber checks for correct coding, modifier usage, demographic match, payer-specific rules, and medical necessity. RCMediX Health utilizes advanced scrubbing technology to catch errors that would otherwise lead to denials, dramatically improving the first-pass clean claim rate.

- Electronic Data Interchange (EDI): The vast majority of claims today are submitted electronically via Electronic Data Interchange (EDI). EDI streamlines the exchange of healthcare information (like the ANSI X12 837 transaction for claims submission) between healthcare providers and insurance companies in a standardized, secure format.

- Clearinghouse Role: Most providers submit claims through a clearinghouse. A clearinghouse acts as an intermediary, receiving claims from providers, scrubbing them for errors, translating them into the payer's specific format, and then securely transmitting them to thousands of different insurance companies. They also receive electronic remittance advice (ERAs) back from payers.

- Direct Submission (Less Common): Some very large healthcare systems may have the capacity for direct EDI connections with major payers, bypassing a clearinghouse.

Importance: Timely and accurate claim submission is paramount for rapid reimbursement. A high first-pass clean claim rate means fewer denials, less administrative rework, and a significantly faster cash flow. Errors at this stage can lead to delays, denials, and lost revenue, highlighting the importance of robust claim scrubbing and efficient EDI processes that RCMediX Health provides.

8. Claim Adjudication & Payment Posting: Understanding the Outcome

Description: After a claim is submitted, the payer reviews it – a process called adjudication – to determine if the services are covered, medically necessary, and if the billing is accurate. Once the payer makes a decision, they remit payment and provide a detailed explanation. The provider then posts this payment to the patient’s account.

Process:

- Payer Adjudication: The insurance company assesses the claim against the patient's policy, contractual agreements with the provider, and their own medical policies and guidelines. They determine the amount they will pay, the amount the patient owes, and any reasons for denial or adjustment.

- Electronic Remittance Advice (ERA) / Explanation of Benefits (EOB):

- ERA (Electronic Remittance Advice): This is the electronic version of the payment notification sent directly from the payer to the provider. It details which claims were paid, denied, or adjusted, along with specific reason codes. ERAs facilitate automated payment posting.

- EOB (Explanation of Benefits): This is a paper or electronic statement sent to the patient, explaining what services were covered by their insurance, the amount paid by the insurer, and the patient's remaining financial responsibility (co-pays, deductibles, non-covered services).

- Payment Posting: This involves accurately applying the payment received from the payer (and any patient payments) to the corresponding patient account and specific service line. It also involves posting any adjustments, write-offs, or identifying underpayments. Proper payment posting reconciles the account and generates the accurate remaining patient balance.

- Identifying Discrepancies: Skilled billers, supported by RCMediX Health's analytics tools, meticulously review ERAs to identify any underpayments, partial payments, or denials. This step is crucial for initiating follow-up actions.

Importance: Accurate and timely payment posting is essential for maintaining correct patient account balances, identifying payment discrepancies, and understanding the true financial performance of the practice. It’s the direct accounting of revenue received and the identification of next steps for any outstanding balances. Automated ERA posting, a feature of modern RCM systems like those deployed by RCMediX Health, significantly speeds up this process and reduces manual errors.

9. Denial Management & Appeals: Recovering Lost Revenue

Description: Despite best efforts, claim denials are an inevitable part of healthcare RCM. Denial management is the systematic process of identifying, analyzing, correcting, and appealing denied or rejected claims to recover the revenue that was initially missed.

Process:

- Identification & Root Cause Analysis: The first step is to quickly identify denied claims (often through ERAs) and, crucially, understand the root cause of the denial. Common denial reasons include:

- Eligibility issues (patient not covered, wrong insurance)

- Prior authorization issues (missing or expired auth)

- Coding errors (incorrect CPT/ICD-10, modifier issues)

- Medical necessity not documented

- Timely filing limits expired

- Duplicate claim submission

- Missing or incorrect patient demographics

- Non-covered services

- Categorization and Trend Analysis: Denials should be categorized by reason, payer, and provider. Analyzing these trends helps identify systemic issues (e.g., specific coding errors, recurring pre-auth problems with a certain payer) that can be addressed proactively to prevent future denials.

- Correction and Resubmission: For correctable denials (e.g., data entry error), the claim is fixed and resubmitted promptly.

- Formal Appeals Process: For denials based on medical necessity or contractual disputes, a formal appeals process is initiated. This involves writing compelling appeal letters, providing additional clinical documentation, and sometimes engaging in peer-to-peer discussions with payers. Each payer has a specific appeals process and timeline that must be rigorously followed.

- Tracking and Reporting: Meticulous tracking of denial rates, appeal success rates, and the financial impact of denials is crucial for continuous improvement.

Importance: Denial management is a critical revenue recovery function. Untouched or poorly managed denials represent significant lost revenue for healthcare organizations. A dedicated denial management team, empowered by sophisticated software like that utilized by RCMediX Health, can drastically improve the net collection rate by overturning denied claims and identifying systemic issues that prevent future losses. This proactive approach ensures that revenue earned for services rendered is ultimately collected.

10. Accounts Receivable (AR) Follow-Up: Proactive Pursuit of Payments

Description: Accounts Receivable (AR) refers to the money owed to the healthcare provider for services rendered. AR follow-up is the systematic process of diligently tracking and pursuing all unpaid claims from insurance payers and outstanding balances from patients.

Process:

- AR Aging Reports: The primary tool for AR follow-up is the AR aging report. This report categorizes outstanding claims and patient balances by how long they have been unpaid (e.g., 0-30 days, 31-60 days, 61-90 days, 90+ days). This helps prioritize follow-up efforts, focusing on older accounts first.

- Payer Follow-Up: For claims pending with insurance companies, the AR team follows up rigorously:

- Checking claim status online via payer portals or EDI 276/277 transactions.

- Calling payers to inquire about processing delays, missing information, or claim status.

- Resubmitting claims that were not received or correcting minor errors.

- Patient Statement Generation: For patient balances, automated or manual patient statements are generated and sent out on a regular cycle, clearly detailing what is owed after insurance.

- Automated Reminders: Modern RCM systems, like those offered by RCMediX Health, can send automated email or SMS reminders to patients about their outstanding balances.

Importance: Effective AR follow-up is vital for maintaining healthy cash flow and reducing days in accounts receivable (DAR) – the average number of days it takes to collect revenue. Without diligent follow-up, claims can age beyond timely filing limits, and patient balances can become increasingly difficult to collect, ultimately becoming uncollectible debt. RCMediX Health’s AR specialists are trained to navigate complex payer systems and patient communication strategies to accelerate collections and minimize outstanding balances.

11. Patient Collections: Fostering Financial Partnership

Description: Patient collections is the final stage of the RCM process, focusing on collecting the portion of the bill that is the patient’s financial responsibility (co-pays, deductibles, co-insurance, and non-covered services) after the insurance has paid its share.

Process:

- Transparent Communication: Clear and upfront communication about financial responsibility, starting from eligibility verification, is the best practice. Patients should understand their expected out-of-pocket costs before service.

- Flexible Payment Options: Offering various payment methods (online payment portals, credit card processing, payment plans) makes it easier for patients to fulfill their obligations. RCMediX Health recommends user-friendly online portals that empower patients to view statements, make payments, and understand their financial history.

- Statement Cycles and Follow-up: Regular, easy-to-understand patient statements should be sent, followed by courteous reminders and, if necessary, phone calls.

- Payment Plans: For larger balances, offering flexible, interest-free payment plans can significantly improve collection rates and maintain positive patient relationships.

- Ethical Collection Practices: Adhering to the Fair Debt Collection Practices Act (FDCPA) and other regulations is crucial. Aggressive or coercive tactics are to be avoided to preserve patient trust and avoid legal issues.

- Third-Party Collections (Last Resort): For highly delinquent accounts that cannot be collected internally, practices may refer them to a reputable third-party collection agency, typically as a last resort.

Importance: With the rise of high-deductible health plans, patient responsibility accounts for a growing portion of provider revenue. Efficient patient collections are critical for securing full revenue, reducing bad debt, and improving cash flow. A patient-centric approach to collections, emphasizing transparency and empathy, as championed by RCMediX Health, not only boosts collection rates but also enhances patient satisfaction and loyalty, turning them into partners in their healthcare journey.

Get Started

Unlock the Full Revenue Potential of Your Practice

RCmediX Health helps transform coding from a risk area into a strategic advantage. Contact us today for a consultation and learn how accurate coding can drive measurable financial improvement.